📘 Compound Financial Instruments under IFRS 9 & Ind AS 109

1. 🌐 Definition

A compound financial instrument (CFI) is a single contract that contains both:

- Liability component → obligation to deliver cash/financial asset (e.g., interest, principal repayment).

- Equity component → residual interest or option to convert into equity (e.g., conversion option).

👉 Classic example: Convertible bonds/debentures

2. 🏗️ Initial Recognition

Both IFRS 9 and Ind AS 109 require split accounting:

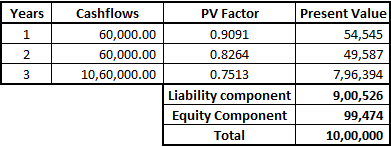

- Step 1: Measure liability component → present value of contractual cash flows discounted at market rate for similar debt without conversion option.

- Step 2: Equity component = residual (issue proceeds – liability component).

- Step 3: Allocate transaction costs proportionately between components.

3. 📊 Subsequent Measurement

- Liability component:

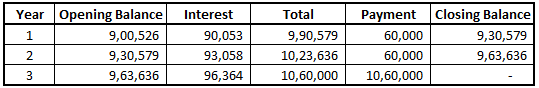

- Measured at amortized cost using the effective interest method.

- Interest expense recognized in P&L.

- Equity component:

- Recognized in equity (often “Other Equity”).

- Not remeasured after initial recognition.

4. 🧮 Numerical Example – Convertible Bond

i. Terms

- Issue proceeds: ₹1,000,000

- Coupon rate: 6% annually

- Term: 3 years

- Market rate for similar non-convertible debt: 10%

ii. Initial Recognition

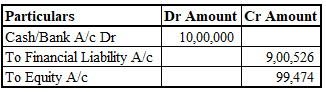

iii. Journal Entry:

iv. Subsequent Recognition (Effective Interest Method)

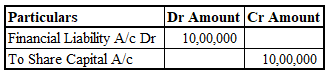

v. At Conversion

- Liability derecognized (₹1,000,000).

- Equity shares issued.

- Equity component (₹99,474) remains in reserves.

- Journal Entry:

5. 📝 Disclosure Requirements

Both standards require disclosure of:

- Nature and terms of instrument.

- Accounting policies for separation.

- Carrying amounts of liability and equity components.

- Impact on reserves and earnings.

✅ Key Takeaways

- CFIs must be split into liability and equity at inception.

- Liability grows under effective interest method; equity remains fixed.

- Conversion leads to derecognition of liability and issuance of shares.

- Both IFRS 9 and Ind AS 109 follow the same conceptual framework, ensuring transparency in reporting.

Finegal Tech Solution

0